local guide program taylor benefits insurance

The Local Guide Program by Taylor Benefits Insurance helps businesses navigate insurance options, including Medicare, wellness programs, and tax credits, while supporting local healthcare providers.

Overview of the Program

The Local Guide Program offered by Taylor Benefits Insurance is a comprehensive resource designed to assist businesses in understanding and selecting the most suitable insurance options for their needs. The program focuses on simplifying the complexities of insurance, including Medicare, wellness programs, and tax credits, while ensuring alignment with local healthcare providers. It provides businesses with a tailored approach to employee benefits, emphasizing cost-effectiveness and personalized solutions. By leveraging expertise in insurance and local healthcare systems, the program helps employers create robust benefit packages that enhance employee satisfaction and overall business performance. This initiative also highlights the importance of supporting local healthcare providers, fostering stronger community ties and improving access to quality care.

Medicare and Local Insurance Programs

Taylor Benefits Insurance bridges Medicare and local insurance options, offering tailored solutions that integrate federal and regional coverage, ensuring cost-effective and comprehensive healthcare support for businesses.

Understanding Medicare Part D and Local Coverage Options

Medicare Part D provides prescription drug coverage, while local insurance programs offer tailored solutions for businesses. Taylor Benefits Insurance helps navigate these options, ensuring cost-effective and comprehensive plans. By integrating Medicare Part D with local coverage, businesses can optimize healthcare benefits, addressing specific employee needs. The program emphasizes understanding enrollment periods, coverage gaps, and cost-sharing to make informed decisions. Local insurance options often align with regional healthcare providers, enhancing accessibility and affordability. Taylor Benefits Insurance experts guide businesses through these complexities, ensuring seamless integration of federal and local benefits. This dual approach maximizes coverage while controlling costs, providing a balanced solution for employee health and business sustainability.

Wellness Programs and Employee Benefits

Taylor Benefits Insurance helps businesses implement wellness programs, improving employee health and productivity. These initiatives often include fitness incentives, mental health resources, and preventive care options.

Designing Custom Wellness Programs for Local Businesses

Taylor Benefits Insurance specializes in creating tailored wellness programs that align with the unique needs of local businesses. By collaborating with local healthcare providers and major wellness carriers, they offer personalized solutions that enhance employee health and productivity. These programs often include fitness incentives, mental health resources, and preventive care options. The goal is to foster a healthier workforce while reducing long-term healthcare costs. Businesses can choose from a variety of customizable options, such as on-site wellness workshops, fitness challenges, and employee assistance programs. Taylor Benefits Insurance also provides guidance on leveraging tax credits and incentives to maximize the benefits of these programs; Their approach ensures that local businesses can create a positive, supportive environment for their employees.

Tax Credits and Incentives for Small Businesses

Taylor Benefits Insurance helps small businesses maximize tax credits through programs like SHOP, improving employee satisfaction and business growth while reducing healthcare costs.

Maximizing Benefits Through the Small Business Health Options Program (SHOP)

The Small Business Health Options Program (SHOP) offers tax credits and incentives to small businesses, helping them provide affordable healthcare to employees. Taylor Benefits Insurance guides businesses through SHOP enrollment, ensuring they maximize available benefits. By leveraging SHOP, businesses can reduce healthcare costs while offering competitive employee benefits. This program is particularly beneficial for small businesses, as it provides flexibility in plan selection and premium payment structures. Taylor Benefits Insurance helps businesses navigate eligibility requirements and enrollment processes, ensuring they make the most of SHOP’s advantages. This support enables businesses to enhance employee satisfaction and retention without overburdening their budget. By utilizing SHOP, small businesses can create a healthier workforce while maintaining financial stability.

Local Guide Program: Key Features and Benefits

The Local Guide Program offers tailored insurance solutions, combining Medicare, wellness initiatives, and tax credits, while supporting local healthcare providers to enhance community health and business growth.

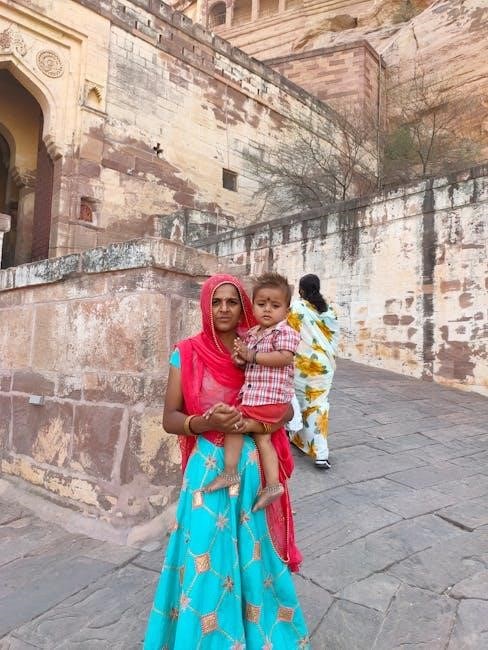

How the Program Supports Local Healthcare Providers

The Local Guide Program by Taylor Benefits Insurance fosters strong partnerships with local healthcare providers, ensuring access to comprehensive coverage and resources. By collaborating with regional networks, the program enhances reimbursement processes and streamlines patient care. It also promotes wellness initiatives, encouraging preventive care and healthier communities. Through tailored insurance solutions, the program supports providers in delivering high-quality services while managing costs effectively. Additionally, it offers educational resources and workshops, helping providers stay updated on the latest healthcare trends and insurance options. This collaboration not only strengthens the local healthcare system but also ensures that businesses and employees receive personalized care, creating a win-win scenario for all stakeholders involved.

Choosing the Right Insurance Plan

Assess your business needs, budget, and employee requirements to select a plan that balances affordability with comprehensive coverage, ensuring long-term financial security and employee satisfaction.

Comparing Local and National Insurance Options

When evaluating insurance plans, businesses must weigh the benefits of local versus national options. Local insurance programs often provide tailored coverage that aligns with regional healthcare needs and costs, while national plans may offer broader networks and standardized benefits. Local options, such as Medicare Part D and state-specific wellness programs, can be more cost-effective for small businesses with localized operations. National plans, however, may provide greater flexibility for companies with multiple locations or employees who require access to care across different regions. Understanding these differences is crucial for selecting a plan that balances affordability, coverage, and accessibility, ensuring both business and employee needs are met effectively. Taylor Benefits Insurance specializes in guiding businesses through this comparison to optimize their insurance strategy.

Customizing Insurance Programs for Specific Needs

Taylor Benefits Insurance offers tailored solutions to meet unique business requirements, ensuring customizing insurance programs that address local healthcare needs and align with business goals effectively.

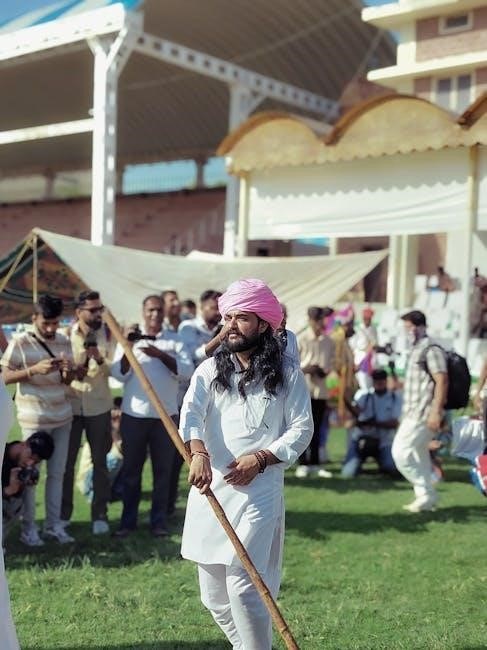

tailoring Benefits to Fit Local Business Requirements

Taylor Benefits Insurance specializes in tailoring benefits to meet the unique needs of local businesses, ensuring coverage aligns with specific requirements and goals. By assessing each business’s unique circumstances, the program offers customized insurance solutions that address local healthcare challenges. This approach ensures that businesses can provide comprehensive coverage while maintaining affordability. The program also emphasizes partnerships with local healthcare providers to enhance accessibility and quality of care. Additionally, Taylor Benefits incorporates wellness programs and tax incentives to support employee health and business growth. This personalized approach helps businesses create a competitive edge while fostering a healthier workforce. The result is a tailored benefits package that truly reflects the needs of the local community and business environment.